Tesla Dojo Shutdown Marks Strategic Pivot to AI5 and AI6 Chips

Hook: In one of the most significant strategic shifts in Tesla’s AI history, CEO Elon Musk has officially shut down the ambitious Dojo supercomputer project. This decision, while ending Tesla’s most daring in-house AI training initiative, marks a calculated pivot toward its AI5 and AI6 chip platforms a move designed to accelerate real-world AI performance in vehicles and robotics while outsourcing training horsepower to established GPU giants.

Key Takeaways

- Tesla Dojo shutdown ends a multi-year, in-house AI training chip project.

- Peter Bannon, head of the Dojo project, exits; remaining engineers reassigned.

- Around 20 former team members have launched DensityAI, a new AI hardware startup.

- Samsung partnership (~$16.5B) will manufacture the Tesla AI6 chip.

- AI5 chip targeted for a 2026 release, optimized for real-time inference in FSD, Robotaxi, and Optimus.

- Large-scale training shifts to NVIDIA/AMD GPUs, reducing hardware risks and accelerating development cycles.

- Analysts view the pivot as a focus on faster product delivery and a reduction in execution risk.

Dojo’s Ambition From Game-Changer to Shutdown

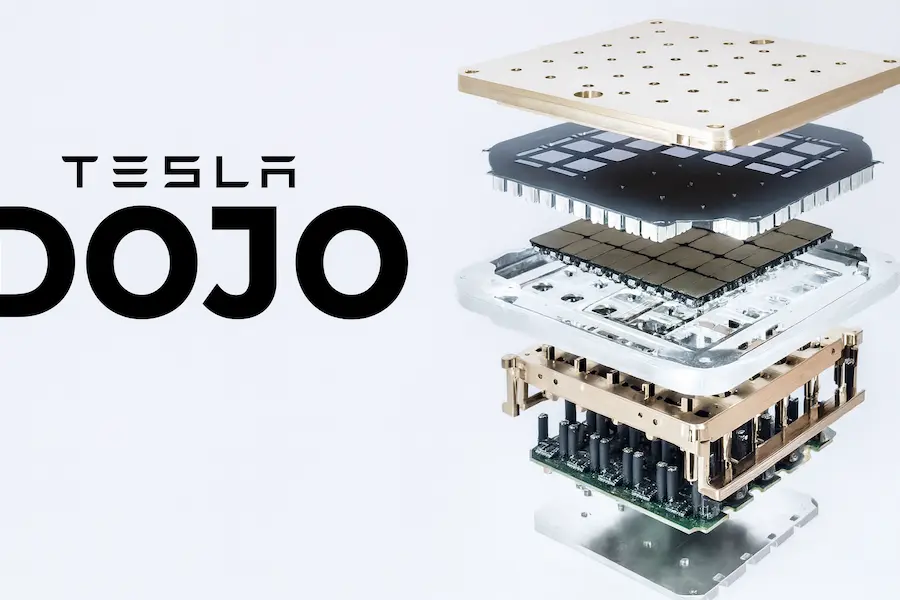

When Tesla unveiled Dojo at AI Day, it was billed as a wafer-scale AI training revolution.

- Powered by custom D1 chips and assembled into training tiles and ExaPODs, Dojo aimed to process massive fleet video datasets for Tesla’s self-driving AI at unmatched efficiency.

- The promise: lower cost per training FLOP, reduced latency, and faster model iteration without relying on external hardware vendors.

Why Wafer-Scale Computing Was So Hard

- Yield Problems: A wafer-scale chip is essentially an entire semiconductor wafer acting as one processor. A single defect can impact large sections of the compute.

- Thermal Challenges: Keeping a wafer-sized processor cool during multi-week AI training runs requires engineering beyond typical chip design.

- Memory Bottlenecks: Despite massive compute potential, limited on-die memory capacity can throttle actual throughput.

- Reliability Risks: Faults discovered late in a long training session can invalidate weeks of progress.

Tesla’s reliance on NVIDIA GPU clusters throughout Dojo’s life suggested the in-house system wasn’t yet ready to fully replace established solutions.

How Tesla Dojo Compared to NVIDIA GPU Clusters

| Feature | Dojo Supercomputer | NVIDIA GPU Cluster |

|---|---|---|

| Architecture | Wafer-scale D1 tiles in ExaPOD configuration | Modular GPUs (H100/B200) in standard racks |

| Strengths | High bandwidth, potential cost savings | Proven reliability, rich software support |

| Weaknesses | Yield/thermal/memory constraints | Vendor dependency, potential cost spikes |

| Status | Discontinued | Active and industry-standard |

Musk’s Public Rationale

In a public X post, Musk explained:

“It doesn’t make sense for Tesla Dojo to divide its resources and scale two quite different AI chip designs. The Tesla AI5, AI6 and subsequent chips will be excellent for inference and at least pretty good for training.”

Interpretation: Maintaining two separate chip architectures slowed progress. The pivot unifies Tesla’s hardware direction, aligning it with products customers use daily cars and robots.

The New Hardware Roadmap

AI5 (Hardware 5)

- Planned Release: 2026.

- Purpose: Inference-first chip to power Tesla’s Full Self-Driving (FSD), Robotaxi fleet, and Optimus robots.

- Benefits: High efficiency, low latency, tailored to Tesla’s autonomy software.

AI6 (Hardware 6)

- Manufacturing: Via Samsung Electronics under a ~$16.5B deal.

- Capabilities: Builds on AI5 architecture with greater compute headroom and limited training capabilities for certain workloads.

Tesla’s Updated AI Compute Strategy

Instead of maintaining a custom training platform like Tesla Dojo, Tesla will:

- Use NVIDIA/AMD GPU clusters for AI model training.

- Focus in-house engineering on edge AI the chips that perform inference inside vehicles and robots.

- Leverage established GPU ecosystems for training speed, reliability, and scalability.

Talent Exodus and DensityAI

The Tesla Dojo shutdown also led to the creation of DensityAI, a startup founded by:

- Ganesh Venkataramanan — Former Dojo program lead.

- Bill Chang — Chip architecture specialist.

- Ben Floering — Systems integration expert.

DensityAI focuses on AI data center hardware for robotics, autonomous driving, and AI agents overlapping with Tesla’s target markets and potentially becoming a partner or competitor.

Competitive Landscape

Tesla’s pivot places it in sharper contrast to:

- NVIDIA Drive: Dominates AI inference in other automakers’ vehicles.

- Waymo: Leverages Google Cloud TPU/GPU training infrastructure.

- Chinese EV startups: Aggressively iterating on domain-specific AI controllers.

Market Reaction

Tesla Dojo stock rose ~2.3% after the announcement, as analysts highlighted:

- Reduced execution risk.

- Streamlined engineering priorities.

- A clearer path to delivering autonomy features sooner.

Morgan Stanley previously estimated Dojo could add $500B in value; while that scenario is now gone, the AI5/AI6 plan may achieve a faster ROI.

Broader AI Industry Context

Tesla’s decision mirrors a larger industry trend even AI leaders like Meta, Microsoft, and OpenAI rely on NVIDIA GPUs for training while building custom inference chips for production workloads.

The takeaway: Training at scale is a capital-intensive, high-risk game, while inference optimization drives immediate product impact.

Future Implications for Tesla

- FSD: AI5 chips could reduce reaction times, improving safety metrics.

- Optimus: Enhanced onboard AI capabilities could expand real-world utility.

- Robotaxi: Lower-latency decision-making could improve ride efficiency and reduce accidents.

Timeline of Key Events

- 2021: Dojo unveiled at AI Day.

- 2023–2024: Limited use; NVIDIA GPU reliance continues.

- Aug 2025: Dojo team disbanded; Bannon exits; DensityAI formed.

- 2026: AI5 launch targeted.

- Post-2026: AI6 follows via Samsung partnership.

FAQ Section (Schema-Ready)

Why did Tesla shut down Tesla Dojo?

To consolidate efforts on AI5/AI6 inference chips and rely on NVIDIA GPUs for training, avoiding resource duplication.

Will FSD slow down without Tesla Dojo?

Unlikely NVIDIA GPUs offer mature, scalable training capabilities, while AI5/AI6 will enhance real-time inference.

What is the Samsung-Tesla Dojo chip deal?

A ~$16.5B contract for Samsung to manufacture the AI6 chip.

Who founded DensityAI?

Former Tesla engineers Ganesh Venkataramanan, Bill Chang, and Ben Floering.

Could Tesla return to in-house training chips?

Possible if cost, supply, or performance advantages emerge in the future.

Expert Insight:

“By focusing on AI5/AI6, Tesla is playing to its strengths building chips that directly enhance the end-user experience while avoiding the capital drain and technical risk of competing with NVIDIA in training hardware.” Industry semiconductor analyst

Conclusion:

The Tesla Dojo shutdown marks the end of a bold in-house AI training experiment, but it’s not a retreat from AI. By focusing on edge inference hardware through AI5 and AI6, and outsourcing training to NVIDIA/AMD, Tesla is betting on speed, scalability, and direct product impact. The real test will come in 2026 with AI5’s launch and whether this pivot delivers the autonomy breakthroughs Tesla promises.

READ ALSO:Top 7 Ways to Master AI Interoperability in Healthcare